The only thing Republicans truly care about

On the implications of the Trump administration's new tax cut push

Republicans may act like they want to transform the GOP into a "workers party," pretend they care about the concerns of struggling coal miners and farmers, rail against abortion, cheer the appointment of conservative judges, and talk about fighting terrorism and deporting immigrants, but there is one thing that matters more to Republicans than anything else — and that is helping the nation's very wealthiest individuals and families become ever richer.

That is the singular domestic achievement of the Republican Party in its 38-year run of dominance over American politics, and it's obviously something the party wants to push as far as it possibly can while it still clings to power in Washington.

Consider: The only major accomplishment of the 115th Congress and the first two years of the Trump administration is the GOP's tax reform bill that dramatically slashed the corporate tax rate while lowering numerous other rates on individuals and businesses. And now, heading into the 2018 midterm elections the administration is looking into a second substantial tax cut to benefit the super-rich even more.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Examining the administration's hopes for partially shielding capital gains (investment earnings) from taxation by indexing them to inflation gives us a window into the Republican Party's priorities, its way of thinking about government, and the likely unintended political consequences of both. All told, the potential change reveals a party increasingly desperate to boost the income and wealth of the very richest among us and displays a mixture of indifference and contempt for everyone else. Here's how:

The GOP's top priority: richer rich people. The Wharton School of Business at the University of Pennsylvania estimates that 86 percent of the benefits of indexing capital gains would go to the top 1 percent of the population. That's because most investment income flows to the top of the economic pyramid. As for the usual justifications of such upper-income tax cuts — that they will stimulate economic growth that benefits everyone — the Congressional Research Service concluded earlier this month that "it is unlikely … that a significant, or any, effect on economic growth would occur from a stand-alone indexing proposal." That means the benefits will go to those who already have substantial income and/or wealth.

An extremely low GOP priority: public debt. As recently as the middle of the Obama administration, Republicans regularly railed against the deficits racked up by a Democratic president striving to prevent the sharpest economic downturn since the Great Depression from becoming even worse. But now? The massive tax cut passed earlier this year has already driven the deficit up to the $1 trillion mark at a time of strong economic growth (when revenue levels should be high relative to what we would expect during the next recession). To this pile of new debt, the administration's capital gains tax proposal would tack on (according to the same Wharton study) an additional $102 billion drop in revenue over the next decade. That's simply not the behavior of a party that cares in any serious way about the federal debt or the country's future fiscal health.

The cable newsification of the party. From the president's obsession with Fox News morning show Fox and Friends, to the White House's recent hiring of long-time Fox News executive Bill Shine, to the president's appointment of CNBC on-air personality Larry Kudlow to serve as chairman of the National Economic Council, this is an administration fixated on flamboyantly right-wing media. No wonder, then, that it is Kudlow, whose role on cable was to play a cartoonish Reaganite supply-sider, who appears to be behind the move on capital gains. The proposed change has nothing to do with good policy and everything to do with a Republican administration playing to type on the reality show broadcast to the nation from the West Wing of the White House.

The drift toward Caesarism. The Constitution gives Congress alone the power of the purse (taxation), yet the administration's proposal on capital gains would usurp it. George H. W. Bush's White House considered a similar move but ultimately backed down, convinced that it would be illegal. Will Trump's Treasury Secretary Steven Mnuchin come to a different conclusion nearly three decades later? Given the tendency of presidents to assert ever-greater power and the growing reluctance of the other two branches to check it, the chances are good that it will. When it comes to securing a tax cut for the well-to-do, Republicans care more about the end than the means.

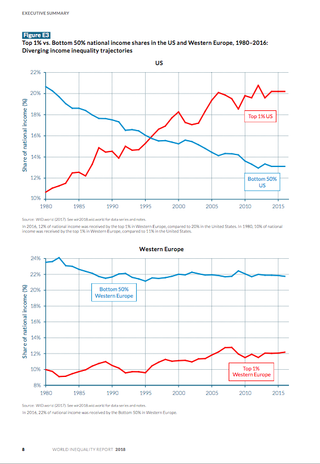

America's engine of inequality. Put it all together and we see that the Republican Party's primary aim is to benefit the super-rich while showing something close to complete indifference to everyone else. Too harsh? Take a look at a chart from the World Inequality Report that's been circulating online over the past week.

On the eve of Ronald Reagan's election, the top 1 percent earned roughly 11 percent of national income while the bottom 50 percent made do with about 21 percent. By 2016, the two groups had swapped places. Now the top 1 percent takes home just over 20 percent of national income while the bottom 50 percent has sunk to roughly 13 percent. In Europe, the two groups began at much the same place as in the United States, but unlike in the U.S. they have remained fairly steady in Europe over the intervening years, with the top 1 percent continuing to earn significantly less than the bottom 50 percent.

Why is the U.S. exceptional in this regard? No doubt in large part because of the Reagan revolution, which convinced Republicans to drastically slash taxes on the wealthy, cut social supports for the poor, and defer in myriad other areas of policy and regulation to the titans of big business — and never to let up on any of it. The trends then encouraged a corporate culture of excessive compensation for the job-creating pseudo-geniuses of the C-suite. And now the Trump administration appears eager to do everything in its power to make this long-term trend toward socioeconomic inequality even worse.

Fuel for the left. With their modest upward tinkering with the tax code and mostly small-ball policy reforms, the Democrats since 1980 haven't done much to accelerate the broad-based trend toward growing inequality. But they've also shown little interest in ameliorating it. That may be changing, in no small part because anger at the injustices of the recent past, especially the Obama administration's failure to punish the individuals and institutions responsible for the financial crisis of 2008, continues to build. Also significant is the increasingly visceral reaction among ordinary Americans to the priorities of the Republican Party's garishly plutocratic leadership.

Tax cuts piled on tax cuts might cheer wealthy Republican donors. But they're also fueling a backlash that the left will use to power its crusade to overturn the Reaganite settlement of the past four decades.

When and if the left achieves its goals, it will have the GOP to thank.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Damon Linker is a senior correspondent at TheWeek.com. He is also a former contributing editor at The New Republic and the author of The Theocons and The Religious Test.

-

The Week Unwrapped: Ultrarunning, menswear and a meaty row

The Week Unwrapped: Ultrarunning, menswear and a meaty rowPodcast Is the "Hardest Geezer" a high-endurance trendsetter? Will Ted Baker survive? And what's the beef with lab-grown meat?

By The Week Staff Published

-

Crossword: April 14, 2024

Crossword: April 14, 2024The Week's daily crossword

By The Week Staff Published

-

Sudoku hard: April 14, 2024

Sudoku hard: April 14, 2024The Week's daily hard sudoku puzzle

By The Week Staff Published

-

Arizona court reinstates 1864 abortion ban

Arizona court reinstates 1864 abortion banSpeed Read The law makes all abortions illegal in the state except to save the mother's life

By Rafi Schwartz, The Week US Published

-

Trump, billions richer, is selling Bibles

Trump, billions richer, is selling BiblesSpeed Read The former president is hawking a $60 "God Bless the USA Bible"

By Peter Weber, The Week US Published

-

The debate about Biden's age and mental fitness

The debate about Biden's age and mental fitnessIn Depth Some critics argue Biden is too old to run again. Does the argument have merit?

By Grayson Quay Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

Henry Kissinger dies aged 100: a complicated legacy?

Henry Kissinger dies aged 100: a complicated legacy?Talking Point Top US diplomat and Nobel Peace Prize winner remembered as both foreign policy genius and war criminal

By Harriet Marsden, The Week UK Last updated

-

Trump’s rhetoric: a shift to 'straight-up Nazi talk'

Trump’s rhetoric: a shift to 'straight-up Nazi talk'Why everyone's talking about Would-be president's sinister language is backed by an incendiary policy agenda, say commentators

By The Week UK Published

-

More covfefe: is the world ready for a second Donald Trump presidency?

More covfefe: is the world ready for a second Donald Trump presidency?Today's Big Question Republican's re-election would be a 'nightmare' scenario for Europe, Ukraine and the West

By Sorcha Bradley, The Week UK Published