Why are we all paying a tax to credit card companies?

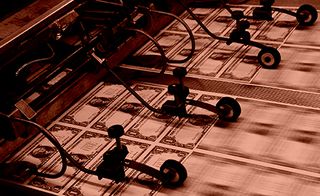

Visa and MasterCard make billions off transaction fees, effectively raising prices on everything you buy

It's fat times for credit card companies.

Visa made $10.3 billion in profits in 2018 on just $20.6 billion in revenue, up from $6.7 billion and $18.3 billion respectively in 2017. Profits were up again to $3.0 billion in the first quarter of 2019, a 14 percent increase from the same period in 2018. Mastercard, meanwhile, took in $5.9 billion in profits in 2018, up almost 50 percent from 2017, and saw a similar 25 percent jump in the first quarter of 2019. Beyond that, individual banks who issue such cards rake in billions more, especially with credit cards. A 2018 Federal Reserve report shows that between 2011 and 2017, large credit card banks have collected returns on assets between 3.37 percent and 5.37 percent — as compared to 1.32 percent for all commercial banks in 2017.

These companies are part of the American payments system — the ways we move money from one place to another. And it's never been easier for consumers to move their money around, to pay for everything — from groceries to movie tickets to hotel rooms — either online or in person with little to no thought about what makes that possible. But these massive profit figures raise some questions: Why on earth are credit cards making so much money? Are the services they provide worth tens of billions? And why aren't debit cards, which function almost identically to credit cards, equally profitable?

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In brief, payment card companies are piggybacking on public systems and guarantees to gouge the American public, especially with credit cards. They act as middlemen, skimming fees off transactions and using their size to bully businesses into accepting their terms — who then raise prices on all consumers. The associated profits, both for Visa and company and the issuing banks, are effectively a tax on everything Americans pay for.

And it doesn't have to be this way.

To understand what exactly the credit card companies do, it's first helpful to think about payment systems more generally. These are simply a way for entities (individuals, businesses, or even governments) to exchange money. That sounds easy, but as economist Perry Mehrling explains, the details are tricky. One has to consider the direction of payment (do you "push" payments from buyers, or "pull" them on behalf of sellers, or both?), the solvency of the participants, the net balance between them, and so on.

Imagining a simplified version of this situation leads directly to a foundational payment technology — the clearing house, which settles payments across all its members at the same time. Instead of every party having to negotiate with all other parties individually, they settle with the clearing house, which calculates net obligations across the whole group. So where bank A might have owed $50 to bank B, been owed $40 by bank C, and owed $5 to bank D, instead it just owes $15 to the clearing house, which in turn calculates the net payments or obligations for all the other banks as well. Most payment systems are at bottom some type of clearing house.

The American payments system specifically has six fundamental pillars: cash, checks, credit cards, debit cards, wire transfers, and the Automated Clearing House (ACH). They all developed separately, but they also overlap and support each other in fundamental ways. To understand how Visa and Mastercard are raking in so much cash, it's helpful to get a sense of the underlying infrastructure on which they rely.

Cash is perhaps the most intuitive of these, but it's also quite peculiar relative to the other systems. Unlike the others, there is no "owner" of the cash system, and no central coordination mechanism where payments are cleared. Instead, payments are negotiated directly between individuals, based on trust. The U.S. dollar bill is one of the most familiar objects in the world, but the very idea of a national paper currency took many centuries to develop. Indeed, paper money was originally developed by private banks, which typically used them as a promissory note — thus the term "banknote." First in China, governments gradually cottoned on to the idea of using paper notes as a general medium of exchange (especially for payment of taxes), usually backed by precious metal reserves. In times of extreme stress (above all war), the metal backing was often abandoned, effectively paying for state needs through an inflationary tax. The resulting low value of paper usually pushed governments back onto gold afterwards. But as gold- or silver-backed money became ever more unworkable, gradually states converged on fiat currency backed by nothing but trust.

The history of American cash follows this pattern precisely. Initially, metal-backed currency was considered ideal, but the state was routinely forced to print to finance wars, with "Continentals" in the Revolutionary War and "Greenbacks" in the Civil War. After the world gold standard collapsed during the Great Depression, fiat currency became the de facto (and eventually legal) reality.

There is a similar history with checks. In the first half of the 19th century, checks from one bank deposited at another had to be cleared between each individual institution, at considerable expense and labor. But in 1853, New York bankers got together to establish the first check clearing house — a group of banks which agreed to accept each other's checks. Then each bank could simply calculate a net settlement each day with respect to the clearing house, dramatically simplifying the process. Other cities and regions quickly followed suit. Finally, the Federal Reserve (established in 1913), pressured banks to hook all the clearing houses together, and accept all checks at face value. Only then did checks become a national payment system.

After the Second World War, banks developed optical scanning systems, which simplified matters, and then the Fed pushed them to develop image-based processing, which allowed clearing with a simple picture. Today, with smartphones and apps, virtually all checks are cleared without the banks ever touching a piece of paper, and any check can be cleared at any bank.

Which brings us to the bigger financial pipelines, whose technology in turn undergirds the card payments system (as well as all businesses of any kind). First, there is the Automated Clearing House, originally developed by banks trying to get around the check-clearing headache. This was the birth of the direct deposit, allowing workers to get their paycheck placed directly into a bank account. Thus ACH is wired into every bank account in the country. What's more, unlike any other system, it can go in both directions — both pushing payments into accounts or pulling them out, allowing for easy automatic bill payment. And it's cheap, with very low transaction fees. Over the years, ACH evolved to become an important system for businesses as well.

Then there are the real heavy hitters — the wire transfer systems. There are two big ones in the U.S.: Fedwire, which is owned and operated by the Federal Reserve, and the Clearing House Interbank Payment System (CHIPS), which is privately owned. These are mostly used for very large transactions between businesses, mostly banks or other financial institutions. Fedwire conducts only individual transactions, and is available to any bank with an account at a Federal Reserve bank (which is most of them), while CHIPS is mainly used by the big Wall Street players and functions as a clearing house. Either are quite cheap to use. But at bottom they work like any online banking service, only with enormously greater security precautions, because the amounts involved are gigantic — routinely over $3 trillion per day at Fedwire, and about $1.5 trillion at CHIPS (which is also a customer of Fedwire).

All this arcane history points to an important lesson: American payments systems only function as well as they do because of state institutions and extensive state regulation. Cash is straight-up produced by the government. The U.S. dollar in general (as the vast majority of dollar transactions do not happen with cash) is a state creation. The Fed controls the national money supply, in addition to running the biggest wire transfer system and the biggest check clearing house in the country.

Government action has also been key in pushing improvements in payment efficiency. Universal check clearing only came about because of state pressure. Banks technically own the ACH, but it is extensively regulated to ensure stability and consistency, and prevent fraud — what's more, the Fed operates one of two ACH "switches" (which coordinate payments between ACH member banks). Moreover, the banks themselves are backstopped by state power at every level. Federal deposit insurance prevents bank runs, and protects savings when banks go under. And as we saw in 2008, when the financial system blows itself up with irresponsible lending and fraud, the state has been there to save it.

So, how do card networks fit in, and why are credit cards so ludicrously profitable?

The card networks are private companies — mostly Visa and Mastercard, which together account for about 72 percent of the market — that banks and merchants can join (American Express accounts for another 22 percent, but it is operated in-house, with no external bank involvement save a couple exceptions). Banks issue cards to their customers, which allows for payments at any merchant who is also part of the network, either directly out of a customer's bank account with a debit card, or with a short-term loan (usually unsecured) with a credit card. In the latter case, if the monthly balance is not paid in full, the bank charges a punishing interest rate on the remaining balance.

But the big money in credit cards today isn't in loans and interest, it's fees. First, there is the "interchange fee" — a percentage charge between the merchant's bank and the customer's bank, set by the network operator, for every transaction. Then the card companies themselves collect additional "swipe fees" (usually a percentage of every transaction), plus a smaller data processing fee and additional charges for international transactions. So when a customer buys something with a card, the money for the purchase price comes from their card-issuing bank and goes to the merchant, but then the merchant's bank pays the customer's bank an interchange fee. Finally, the merchant pays a swipe fee to the card company separately.

In other words, the card companies do not directly collect the interchange fees, but effectively collect a cut of it after the fact with their own fees, as the overall fee volume is mostly determined by the interchange rates, which they set. It's a complicated setup, but it allows the card companies to pose as if they are are not financial institutions (thus avoiding a lot of regulation), and to leave headaches like unpaid card balances to the banks.

There is no possible moral or economic justification for these fees. Credit card companies and their bank allies are just abusing their market power to soak the rest of society for easy fat profits.

It's key to realize that simple network effects account for a huge proportion of the value of these systems. The card companies (originally set up by banks, but later spun off into their own companies) did do a lot of work to get them off the ground with advertising, network-building, ensuring interoperability in multiple countries, and so on, but today their sheer size and universality are why credit cards are so ubiquitous. Once they got up to a big enough scale, everyone else had to join up or lose out on tons of business. As the 2018 Federal Reserve Payments Study notes, in 2000 there were 15.6 billion and 8.3 billion credit and non-prepaid debit card transactions respectively, while in 2017 the figures were 40.8 billion and 69.6 billion. That's why Visa and Mastercard are accepted at virtually every major business today.

Moreover, the card companies and card-issuing banks rely on the other major payment systems to move money around in their own right. The merchants from whom they extract money also require a stable payment system to conduct their business, as do their consumers to go about their daily lives. Without the underlying infrastructure of ACH, Fedwire, and so on, plus all the regulations to protect those systems, card networks would not be nearly as stable or reliable as they are. They might well not even exist at all.

So why aren't debit cards as profitable? Simple: They aren't allowed to be. As mandated by the Dodd-Frank financial reform, the Fed capped interchange fees on debit cards at 0.05 percent of the transaction, plus 22 cents (though not all types of debit cards are included). This slashed average debit interchange costs when it took effect in 2012.

But credit cards were not included in this section of Dodd-Frank at all, and naturally charge much higher amounts. For consumer credit cards, interchange fees typically run between 1.55-1.95 percent (that is, 31-39 times the regulated debit percentage fee) plus 10 cents, but can get as high as 2.95 percent for certain corporate cards. Indeed, all the big players have been steadily jacking up their fees over time — so high that some major businesses (like the supermarket chain Kroger) have begun to withdraw from Visa in protest.

There is no possible moral or economic justification for these fees. Credit card companies and their bank allies are just abusing their market power to soak the rest of society for easy fat profits. Merchants paid $64 billion in interchange fees just to Visa and Mastercard in 2018, an increase of 17 percent from the previous year and 77 percent from 2012. And while merchants pay these fees directly, and credit card holders do get a partial kickback in the form of various rewards programs, ultimately consumers pay in the form of higher prices — including those who don't even use credit cards. Indeed, the prices of all American goods and services are an estimated 1-2.5 percent higher to cover just interchange fees — effectively a moderate national sales tax that goes directly into the pockets of a few big corporations. (Last year Visa and Mastercard paid $6.2 billion to settle a class-action lawsuit from 12 million merchants, who accused them of illegal price-fixing.)

There is no reason whatsoever why credit cards should not be regulated like debit cards — their obscene profit margins are evidence enough of that. Perhaps the Fed might grant them a slightly higher rate on account of larger and more complicated networks. Whatever the case, simply studying their books and mandating fee schedules that would cut card company profits by 95 percent, and bring card-issuing bank returns in line with regular banks, could be done easily, with an enormous net benefit. Some big spenders would lose out on cheap vacation flights, but the entire population (aside from a few investors and executives) would enjoy a substantial bump in their real income.

Or, the networks could simply be nationalized. The Fed already has its hands deep in every aspect of American payments systems, or is running them outright. It would be a trivial matter for it to take on credit card operations, setting the fees at whatever it takes to cover the system's operational costs and no more.

A third option would be for the government to set up its own card system, perhaps as part of a postal banking program. No-frills debit and credit cards, run as cheaply as possible, could provide an alternative for merchants and unbanked Americans alike, while good old-fashioned market competition would force Visa and Mastercard to cut prices. (Indeed, pushed in part by retailers like Walmart and Target, the Fed recently announced it is developing a real-time settlement system. This would primarily eliminate the lag between purchase and payment for debit cards, but could also eventually bypass the card networks altogether.)

Despite the tangle of institutions, most of the American payment system is quite cheap, efficient, and reliable — the result of well over a century of sustained government pressure and institution-building. Conversely, the immense profits of Visa, Mastercard, and the card-issuing banks are sheer parasitism. In an age of worldwide computer networks and near-instantaneous communication, it ought to cost virtually nothing to buy something. With just a little more public effort, that could become a reality.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Winchcombe meteorite: space rock may reveal how water came to Earth

Winchcombe meteorite: space rock may reveal how water came to EarthThe Explainer New analysis of its violent journey confirms scientific theories on the origin of our planet's H2O

By Sorcha Bradley, The Week UK Published

-

Liz Truss to save the West: is a political comeback really on the cards?

Liz Truss to save the West: is a political comeback really on the cards?Talking Point The former prime minister is back with a new tell-all memoir

By Richard Windsor, The Week UK Published

-

Fallout: one of the 'most faithful – and best – video game adaptations'

Fallout: one of the 'most faithful – and best – video game adaptations'The Week Recommends This 'genre-bending' new Amazon series is set in a post-apocalyptic wilderness where survivors shelter below ground

By Adrienne Wyper, The Week UK Published

-

Arizona court reinstates 1864 abortion ban

Arizona court reinstates 1864 abortion banSpeed Read The law makes all abortions illegal in the state except to save the mother's life

By Rafi Schwartz, The Week US Published

-

Trump, billions richer, is selling Bibles

Trump, billions richer, is selling BiblesSpeed Read The former president is hawking a $60 "God Bless the USA Bible"

By Peter Weber, The Week US Published

-

The debate about Biden's age and mental fitness

The debate about Biden's age and mental fitnessIn Depth Some critics argue Biden is too old to run again. Does the argument have merit?

By Grayson Quay Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

Henry Kissinger dies aged 100: a complicated legacy?

Henry Kissinger dies aged 100: a complicated legacy?Talking Point Top US diplomat and Nobel Peace Prize winner remembered as both foreign policy genius and war criminal

By Harriet Marsden, The Week UK Last updated

-

Trump’s rhetoric: a shift to 'straight-up Nazi talk'

Trump’s rhetoric: a shift to 'straight-up Nazi talk'Why everyone's talking about Would-be president's sinister language is backed by an incendiary policy agenda, say commentators

By The Week UK Published

-

More covfefe: is the world ready for a second Donald Trump presidency?

More covfefe: is the world ready for a second Donald Trump presidency?Today's Big Question Republican's re-election would be a 'nightmare' scenario for Europe, Ukraine and the West

By Sorcha Bradley, The Week UK Published