WeWork: Startup mania reaches its apex

Get ready for the most polarizing IPO of the year

The smartest insight and analysis, from all perspectives, rounded up from around the web:

Get ready for the most polarizing initial public offering of the year, said Dan Primack at Axios. Among the most highly hyped of the multibillion-dollar startup "unicorns," WeWork filed the prospectus for its long-awaited IPO last week, raising expectations that the office-rental company, valued at $47 billion, could go public in September. But "there is a ton of investor skepticism over WeWork's business model." While it nearly doubled its revenue ($1.5 billion) and membership (527,000) in the past year, it remains deeply unprofitable, losing $904 million in the first half of 2019. It's also a "one-man" show, built around its high-profile founder, Adam Neumann. And, boy, that man has found some striking ways to profit from his company, said Matt Levine at Bloomberg. For instance, WeWork paid Neumann $5.9 million to acquire the trademark "We." That's right: "Neumann owned the name of the company he founded and sold it to company." This is unusual. Mark Zuckerberg "not only invented Facebook, he also named it Facebook. But it did not occur to him to charge à la carte for those services." WeWork has also given Neumann loans to buy buildings, then leased those same buildings back from him. The IPO will give him enough special voting shares to control the company for his lifetime — and if that's not long enough, he decides who gets those voting rights after he dies.

"I am very excited to see who will pony up for shares" in this IPO, said Elizabeth Lopatto at TheVerge. "Our mission," WeWork's prospectus says, "is to elevate the world's consciousness." It wants to rebrand itself as "The We Company" and jump into private schools (WeGrow) and apartment buildings (WeLive). It's about "inclusivity" and "inspired" communities. Amid all this, WeWork has been trying to pose as a tech company to naïve investors. "It's not a tech company. It's a soap opera."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Whether you call WeWork a tech company or a real estate company doesn't really matter, said Jeremy Bowman at MotleyFool. What's important is that "WeWork has dominant mindshare in its space." WeWork's critics keep comparing it to other office rental companies. Really? When I tell people I work in a co-working space, they always assume, albeit wrongly, that it's WeWork. "No one has ever mentioned another co-working company to me." That's why WeWork is "growing at a torrid pace." Sure, there are reasons to be skeptical about WeWork, but "remember that investors pay for growth above all else."

Yes, growth "gets investors justifiably excited, and they may be willing to overlook eye-watering losses," said Shira Ovide at Bloomberg. But WeWork's "outlandish mission statements," "Russian nesting-doll" structure, and massive losses make it shocking even by current standards. WeWork has taken the "startup mania era to its logical extreme." The current crop of tech unicorns, such as Uber and Airbnb, have spent billions to bust into traditional businesses and "forced every conventional industry to change what it does or risk death." But it's not clear that these unicorns will thrive and profit in the era they've sparked.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

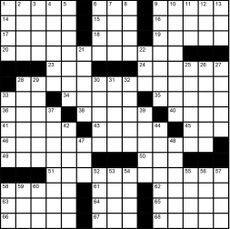

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine printables - April 26, 2024

Magazine printables - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published